Eventually, borrowers will likely be paying out a lot more in principal than interest and that is once they can build fairness in their household Substantially faster. You will find other prices Together with the month-to-month property finance loan payments to your $140K mortgage, for example property tax, property insurance coverage, HOA expenses, PMI, utility bills, and home servicing. First-time residence potential buyers ought to keep an eye on these expenditures since they add up swiftly.

Acquiring a property finance loan for a home is actually quite uncomplicated. I like to recommend these ways. one. Talk to your neighborhood lender. two. Check out a mortgage provider to see charges and acquire a web based estimate. A house loan banker commonly wants several many years of tax returns in addition to a assertion of your respective property and debts.

Use this loan calculator to find out your month to month payment, curiosity rate, number of months or principal amount of money over a loan. Uncover your excellent payment by modifying loan quantity, desire amount and phrase and seeing the impact on payment sum.

Enter your specifics above to work out the regular monthly payment. What's the deposit on a 140k dwelling?

It truly is feasible that only one quarter of one per cent can wind up preserving tens of 1000's around the length of your loan. Also, beware any costs included for the mortgage. This could vary significantly based on the home finance loan provider.

It can be possible that just one quarter of one per cent can end up saving tens of countless numbers around the length in the loan. Also, beware any expenses included towards the house loan. This will vary significantly with regards to the property finance loan provider.

They are going to also want information of your private home order. Usually, you will get an appraisal, a home inspection, and title insurance coverage. Your property agent or financial institution can organize this for you personally.

One of several shocking items I uncovered is how a small distinction in prices can have an effect on your complete quantity compensated. Check out utilizing the calculator to check different desire premiums.

Among the list of shocking issues I learned is how a little variation in prices can affect your full volume paid. Check out using the calculator to examine diverse interest premiums.

Include property taxes, insurance plan, and upkeep prices to estimate Total house possession costs. Shell out a higher down payment or refinance to lower regular monthly payments. Don't be afraid to check with your lender for much better premiums. How do curiosity premiums impact check here a home finance loan of 140k in a six APR?

They are going to also want facts of your home acquire. Ordinarily, you will get an appraisal, a home inspection, and title insurance policy. Your real estate property agent or lender can set up this for you personally.

This is termed personal property finance loan insurance coverage, or PMI which can be a safety that lenders use to safeguard by themselves in case of default from your borrower.

If you acquire out a loan, it's essential to pay back again the loan moreover desire by building common payments to your financial institution. So you're able to consider a loan as an annuity you pay back to the lending institution.

5% desire amount, you would probably be checking out a $503 regular monthly payment. Make sure you Remember that the precise Value and month to month payment for the property finance loan will range, based its duration and terms.

Acquiring a house loan for a house is really pretty uncomplicated. I recommend these techniques. 1. Speak with your neighborhood bank. 2. Try a house loan provider to look at rates and obtain an online estimate. A property finance loan banker normally would like a number of yrs of tax returns in addition to a statement of one's property and debts.

You can also develop and print a loan amortization agenda to see how your month to month payment can pay-from the loan principal moreover interest above the study course of your loan.

Taking a look at this loan table, it's easy to find out how refinancing or spending off your property finance loan early can definitely affect the payments of your 140k loan. Include in taxes, insurance policy, and upkeep charges to obtain a clearer image of All round property ownership expenses.

Jeremy Miller Then & Now!

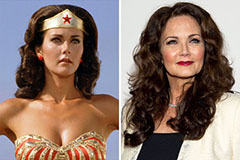

Jeremy Miller Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!